Solana Volume: Exploring the Key Metrics of the Solana Blockchain

Solana Volume is a key indicator of the network's health, popularity, and utility. By understanding its components, factors, and impacts, users can better navigate the evolving Solana ecosystem.

Solana, one of the fastest-growing blockchain networks, has garnered significant attention for its unique features and high performance. A key metric that sheds light on the activity and health of the Solana ecosystem is Solana Volume. But what exactly does this term mean, and why is it important? Let’s dive in to explore the dynamics of Solana Volume.

Why Solana Volume Matters

Solana Volume isn’t just a statistic; it’s a pulse check for the entire blockchain. Whether you’re a trader, developer, or investor, monitoring this metric helps you gauge user activity, market trends, and even the network’s overall performance.

Understanding Solana Blockchain

Overview of Solana

Launched in 2020, Solana is a high-performance blockchain designed to provide fast, secure, and scalable decentralized applications (dApps). Its architecture supports thousands of transactions per second (TPS), making it a favorite among developers and enterprises.

Unique Features of Solana Blockchain

Proof-of-History Mechanism

One of Solana’s standout features is its Proof-of-History (PoH) mechanism. This innovative consensus algorithm allows Solana to achieve lightning-fast transaction speeds while maintaining security.

High Throughput and Scalability

Unlike many blockchains struggling with scalability, Solana offers seamless performance even during periods of high traffic. Its robust infrastructure can handle large volumes of data and transactions.

What is Solana Volume?

Definition of Solana Volume

Solana Volume refers to the total number of transactions or the total value of assets traded on the Solana network within a specific timeframe. This can include activities in DeFi protocols, NFT marketplaces, and general token transactions.

Components of Solana Volume

Key components of Solana Volume include:

- Transactional activity in dApps

- Trading volumes of Solana-based tokens

- Marketplace activity, especially NFTs

Factors Influencing Solana Volume

Market Sentiment

Investor sentiment towards Solana directly impacts its volume. Positive news or partnerships often lead to spikes in activity.

Adoption of dApps on Solana

The increasing adoption of decentralized applications (dApps) like Serum and Raydium significantly contributes to Solana’s transaction volume.

NFT Trends and Marketplace Activity

NFTs are a major driver of Solana Volume. Platforms like Magic Eden and Solanart frequently experience high trading activity, impacting the overall metrics.

How Solana Volume Impacts Price and Market Trends

Correlation Between Volume and Price Movements

An uptick in Solana Volume often correlates with price fluctuations, offering insights into market behavior and liquidity.

Spot vs. Derivative Markets on Solana

Spot trading reflects immediate asset purchases, while derivatives involve contracts based on Solana’s future price, both contributing differently to the overall volume.

Tools to Track Solana Volume

Popular Analytics Platforms for Solana Metrics

Platforms like Solscan and Solana Explorer are excellent resources for monitoring transaction volumes and network health.

Solscan and Solana Explorer

Solscan provides detailed insights into Solana’s blockchain activity, while Solana Explorer focuses on transaction histories and network performance.

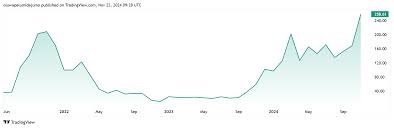

CoinMarketCap and TradingView

These platforms provide macro-level views of Solana’s trading volumes and price movements, useful for traders and analysts alike.

Benefits of Monitoring Solana Volume

Identifying Market Opportunities

By analyzing Solana Volume, traders can spot buying or selling opportunities and make informed decisions.

Understanding Network Health

High volume is often a sign of a healthy, active network, while low volume could indicate stagnation or reduced user interest.

Comparing Solana Volume with Other Blockchains

Solana vs. Ethereum Volume

Ethereum remains a leader in trading volume, but Solana’s efficiency and low fees make it a strong contender for specific use cases like gaming and NFTs.

Solana vs. Avalanche Volume

Both Solana and Avalanche aim to solve scalability issues, but Solana’s higher throughput gives it an edge in volume metrics.

Challenges and Limitations of Solana Volume

Data Accuracy Issues

Relying solely on blockchain explorers might not provide a complete picture, as some data may be inaccurate or delayed.

Impact of Network Congestion

During peak times, Solana has faced congestion, affecting transaction speeds and overall volume.

Real-World Use Cases Influencing Solana Volume

NFT Marketplaces

NFTs have played a pivotal role in driving Solana Volume, with marketplaces like Magic Eden seeing immense traction.

Decentralized Finance (DeFi) Applications

Solana’s DeFi ecosystem, featuring platforms like Serum and Solend, continues to contribute significantly to its transaction volume.

Future Trends in Solana Volume

Growth of Gaming on Solana

Blockchain gaming is an emerging trend, and Solana’s scalability positions it as a preferred network for gaming developers.

Institutional Interest in Solana

With more institutions exploring blockchain solutions, Solana’s volume is expected to grow as large-scale projects adopt the network.

Conclusion

Solana Volume is a key indicator of the network's health, popularity, and utility. By understanding its components, factors, and impacts, users can better navigate the evolving Solana ecosystem. As blockchain adoption continues to rise, Solana Volume will remain a crucial metric for traders, developers, and investors alike.

FAQs

1. What makes Solana Volume unique compared to other blockchains?

Solana Volume stands out due to its high transaction speeds and low fees, making it ideal for applications like NFTs and gaming.

2. How does Solana’s Proof-of-History impact its volume?

Proof-of-History enables faster transaction processing, which directly contributes to higher transaction volumes.

3. Which industries are driving Solana Volume?

The NFT and DeFi sectors are the primary drivers of Solana’s transaction volume.

4. Is high Solana Volume always an indicator of success?

Not necessarily. High volume may indicate activity but doesn’t always guarantee a sustainable or healthy network.

5. What tools should beginners use to track Solana Volume?

Beginners can use platforms like Solscan, Solana Explorer, and CoinMarketCap for reliable Solana Volume metrics.

What's Your Reaction?